Social Security Tax 2025 Limit - Limit On Social Security Tax 2025 Kelcy Melinde, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). This amount is known as the “maximum taxable earnings” and changes each. 2025 Social Security Disability Earnings Limit Roxy Wendye, 2025 brings encouraging news for those saving for retirement. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2023).

Limit On Social Security Tax 2025 Kelcy Melinde, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400). This amount is known as the “maximum taxable earnings” and changes each.

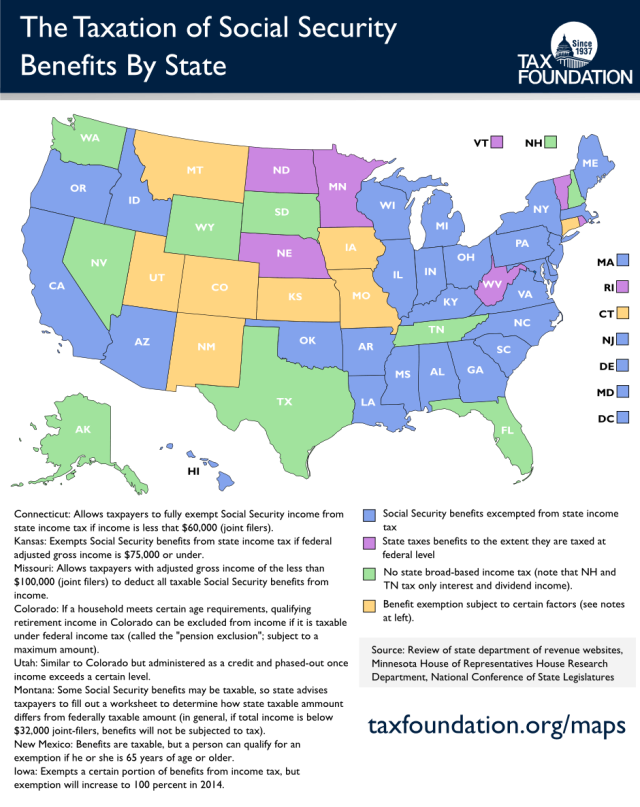

Social Security Tax Brackets 2025 Hedi Raeann, The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits. In 1983, the social security payroll tax was imposed on 90 percent of the country’s wage income.

The irs has announced an increase in the contribution limit for 401 (k) plans to $23,000, up from.

The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. The maximum amount of social security tax an employee will have withheld from.

Social Security Limit What Counts As YouTube, According to the social security administration (ssa), employers and employees each pay 6.2% of wages up to the taxable maximum of $168,600 in 2025,. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Limit For Maximum Social Security Tax 2025 Financial Samurai, Wealthier taxpayers will have more social security tax taken from their paychecks this year due to a wage base increase. In 1983, the social security payroll tax was imposed on 90 percent of the country’s wage income.

Limit For Taxable Social Security, To elaborate, the tax rate is generally 6.2%, meaning a worker with income. According to the social security administration (ssa), employers and employees each pay 6.2% of wages up to the taxable maximum of $168,600 in 2025,.

Starting in 2025, the ceiling on earnings subject to social security payroll taxes will increase to $168,600 from the previous $160,200.

But that limit is rising in 2025, which means seniors who are working and.

2025 Contribution Limits Announced by the IRS, The maximum social security employer contribution will. The irs reminds taxpayers receiving social security benefits that they may have to pay federal income tax on a portion of those benefits.

Social Security Irmaa Brackets 2025 Mufi Tabina, The wage base or earnings limit for the 6.2% social security tax rises every year. A proposal to end federal tax on social security retirement benefits would provide relief for retirees as early as next year.